MenuClose

There's been a lot of talk about interest rates and inflation on the news recently. We've also covered these topics in some of our recent blogs.

With increases continuing and ongoing questions from clients, we thought we'd bring in expert and friend of Maxim, Joel Archer from Ascension Finance, to give an update on the current status quo and what we can expect in 2023.

His summary includes the latest refinancing statistics, looks at rent price rises and explores current residential building trends.

Australian financing and property market outlook - Joel Archer, Ascension Finance

Refinancing activity has reached record levels as homeowners and investors look for better home loan options to lower their repayments.

With the Reserve Bank of Australia (RBA) continuously raising the cash rate, borrowers are refinancing their loans in large numbers to save money on their monthly payments.

In December, a record $19.5 billion worth of loans were refinanced, a 20.4% increase from the previous year and an 88.2% increase from two years before.

The RBA increased rates again in February, bringing the cash rate to 3.35%, the highest level since September 2012. They've also indicated that there may be more rises in the near future.

Many banks have already announced they'll be passing on the February rate increase to their variable home loan customers.

These rate increases mean that a 25-year loan of $500,000 with principal and interest repayments could increase by nearly $75 per month with the latest 25 basis point increase.

This means a monthly repayment increase of $910 compared to May 2022.

Economists from the big four banks have made predictions about future rate movements:

It's important to note that although lenders tend to pass on these rate increases in full, they're also competing for your home loan business and often offer lower rates to new customers than their existing clients.

If it's been a while since you took out your home loan, it may be worth considering speaking to a mortgage broker about reviewing your loan to ensure you're not paying more than you need to.

A mortgage broker can help you compare rates from various lenders and find a home loan that suits your needs and budget.

The Australian rental market experienced a significant rise in rental incomes in 2022 as the national vacancy rate fell to a record low.

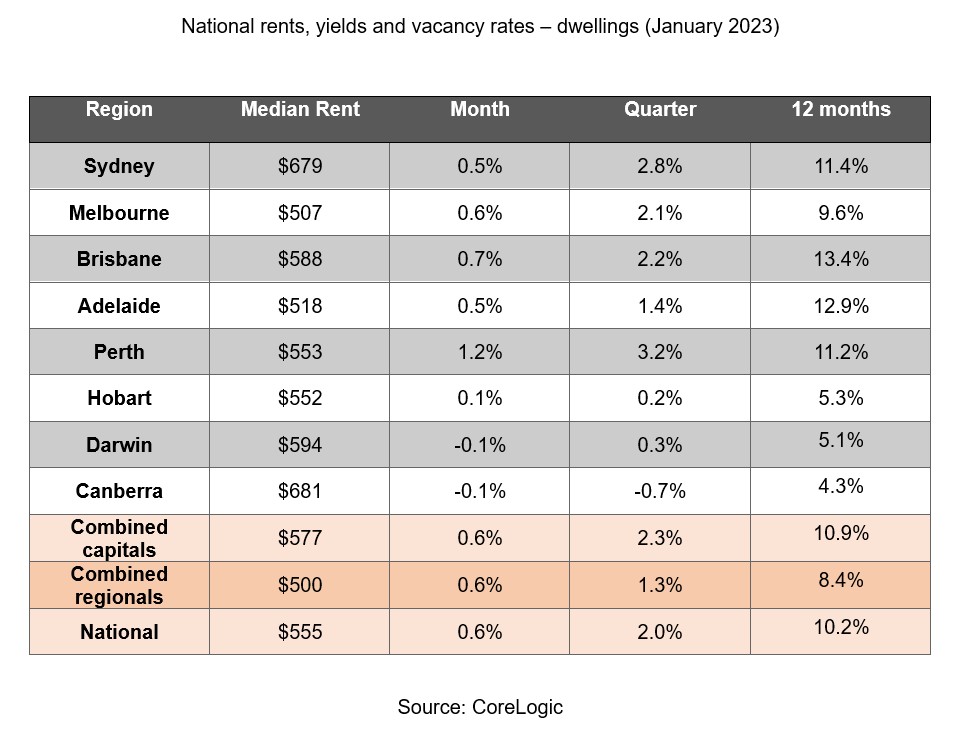

According to CoreLogic, the median rent for an investment property in Australia increased by 10.2% during the year, with Brisbane and Adelaide experiencing the highest increases of 13.4% and 12.9%, respectively.

The low vacancy rate of 1.2% in December 2022 has forced tenants to compete harder, driving up rents across the country.

Between September 2020 (when this period of rental increases began) and December 2022, Australian rental rates increased 22.2% – the largest increase in a 27-month period in recorded history.

As a result of strong rental returns and low vacancy rates, there has been increased interest from both first-time and existing investors looking to expand their portfolios. However, the recent interest rate hikes have reduced borrowing capacity, preventing many from taking advantage of potential opportunities.

Despite the current market conditions, investors still have opportunities in certain areas of the country.

Some areas of note include Bundaberg, Toowoomba, and Rockhampton in Queensland, which have seen significant increases in rental prices, and Albury-Wodonga, a border town between NSW and VIC, which has experienced a boost in infrastructure and low vacancy rates.

The Barossa Valley in SA, which offers affordable properties in a famous wine region, also presents an attractive opportunity for investors.

It's worth noting that investors should always do their due diligence and consider a range of factors beyond just rental prices and vacancy rates, such as potential capital growth, population growth, and the area's overall economic and political environment.

Additionally, it's important to work with a trusted and experienced property investment advisor to help navigate the market and find the best investment opportunities.

The residential construction industry has experienced a significant increase in building costs in recent years, with 2022 seeing the largest annual increase on record since the GST was introduced, according to CoreLogic's Cordell Construction Cost Index (CCCI).

The report found that residential construction costs rose by 11.9% in 2022 after increasing by 7.3% in 2021. However, the pace of the price increase seems to have slowed down in the last quarter, with a rise of 1.9%, compared to a 4.7% increase in the September quarter.

Although the worst of the cost increases might be behind us, CoreLogic's Construction Cost Estimation Manager, John Bennett, noted that volatile timber prices, increased metal product costs, higher petrol prices, and increased gravel, aggregate, and fill prices continue to impact the industry.

The increased costs for appliances and fittings have also added to the cost of residential construction.

Despite a pipeline of residential construction work still to be completed, the drop in dwelling approval figures of 41% since March 2021 has helped to alleviate some pressure on the industry.

Additionally, the opening of borders and arrival of skilled workers are expected to positively impact the construction industry as labour shortages persist.

One factor that could impact the building industry in the future is rising interest rates and inflation, which may cause builders and suppliers to become more cautious.

Overall, while building costs have risen significantly in recent years, the pace of that growth may be slowing, offering some hope for the residential construction industry.

If anything has jumped out in this post that you want to explore further, get in touch with our team or contact Joel - details below.

Joel Archer is the Principal Broker at Ascension Finance. He's worked in financial services for over 20 years and is experienced in many aspects of the lending cycle. He specialises in helping first-time property investors, clients looking to upgrade their homes and those wanting to access existing equity or obtain a better rate. He also helps first-home buyers realise the dream of home ownership.

Joel Archer – Ascension Finance

(02)4925 1080 | joel@ascension.finance | Book a Calendly meeting