MenuClose

As the COVID economic landscape continues to take shape, Australian Federal Treasurer Josh Frydenberg has handed down the 2022-23 Federal Budget.

Some of the initiatives that may directly affect you are listed below.

Remember, at present these are just proposals and could change as legislation passes through parliament.

FOR BUSINESSES

New technology investment boost for small businesses

Small businesses with an aggregated annual turnover of less than $50 million will be able to deduct an additional 20 per cent of expenditure incurred (ie. a deduction for 120%) on business expenses and depreciating assets such as portable payment devices, cyber security systems or subscriptions to cloud-based services that support their digital adoption up to an annual cap of $100,000 of expenditure.

The temporary increased deduction will be available for eligible expenditure incurred between 7:30pm (AEDT) on 29 March 2022 and 30 June 2023.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2023 will be included in the income year in which the expenditure is incurred.

New skills and training boost for small businesses

The Government is introducing a skills and training boost to support small businesses to train and upskill their employees. The boost will apply to eligible expenditure incurred from 7:30pm (AEDT on 29 March 2022) until 30 June 2024. Small businesses with aggregated annual turnover of less than $50 million will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees.

The external training courses will need to be provided to employees in Australia or online and delivered by entities registered in Australia. Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024, will be included in the income year in which the expenditure is incurred.

Expansion of access to Employee Share Schemes

The Government announced that it will expand access to employee share schemes (ESS) and further reduce red tape so that employees at all levels can participate.

This announcement confirms the Government’s intention to expand access to participants of ESS in unlisted companies by allowing participants to invest up to:

without the unlisted company having to comply with the standard regulatory requirements in the Corporations Act 2001 for operating a business offering shares and financial products to retail clients.

No start date for this incentive has been announced at this stage.

Income tax exempt COVID-19 Grants

The Government announced that it will extend the measure which enables payments from certain state and territory COVID-19 business support programs to be made non-assessable non-exempt (NANE) for income tax purposes until 30 June 2022.

The Government has made the following grant programs eligible for NANE treatment since the 2021–22 MYEFO:

FOR INDIVIDUALS

Temporary cut in Fuel Excise

The Government announced temporary relief from fuel price pressures by halving the excise and excise-equivalent customs duty rate that applies to petrol and diesel for six months from 12.01 am on 30 March 2022 until 11.59 pm on 28 September 2022. It is expected that this will take a couple of weeks to flow through to bowser prices.

Cost of Living payments

The Government has announced that it will provide eligible recipients with a tax-exempt support payment of $250 to assist with higher cost of living pressures. The payments will be made in April 2022 and will be targeted to Australian residents who are recipients of most major types of social security payments and concession card holders.

Increase in the LMITO

The Low and Middle Income Tax Offset (LMITO) will be increased to up to $1,500 for individuals for the 2021-22 financial year. All eligible LMITO recipients will benefit from the full $420 increase, referred to as the Cost of Living Tax Offset. Consistent with current arrangements, eligibility for LMITO will be assessed when individuals lodge their tax returns for the 2021-22 income year. Those individuals earning over $126,000 are not eligible for the offset. The LMITO is due to end on 30 June 2022 and has not been extended.

Affordable housing and home ownership

The Government has announced that it will expand the existing Home Guarantee Scheme to:

Cost of COVID-19 testing

The Government has announced that from 1 July 2021:

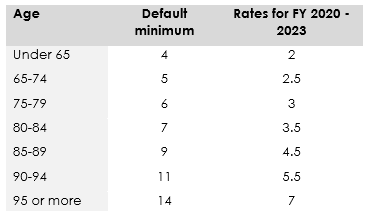

Superannuation pension payments

The Government announced that it will extend the 50 per cent temporary reduction of the superannuation minimum drawdown requirements for account-based pensions and similar products for a further year to 30 June 2023.

The minimum drawdown rates are:

Please contact us with any queries and stay safe.